10 Must-Follow Tips for Buying a House for Airbnb in 2026 – Defining Goals, Property Type, Tax Terms & Conditions

Buying a house for Airbnb is an interesting alternative to developing your income. Indeed, this famous platform is today essential in renting furnished tourist accommodation. But the process remains framed by the law, and the slightest infraction risks costing you dearly. Such investment can generate much more income than a traditional rental, especially if the property is high-end. In this article, we will advise on buying an apartment for rent.

What are the advantages of buying a rental property? What precautions should be taken before buying? Here are 10 tips for a successful rental investment in Airbnb.

10 must-follow tips for buying a house for Airbnb

Why you should consider buying a house for Airbnb

Real estate goes through cycles, but demand is growing due to rising demography, the increase in single-parent families or single people, the scarcity of building land, etc. To meet this need, rental investment offers many advantages:

- Acquiring an apartment, a studio, or a house is to buy a tangible and durable asset that will always keep an intrinsic value on resale, but also less volatile than the stock market, for example.

- Real estate rentals benefit from credit leverage. With a small personal contribution, you can buy a property partly financed by rents collected, leveraging a tangible asset. Credit-linked insurance adds security, covering repayment in case of death or disability of one party.

- With a rental property, you keep control of your investment: you are the one who makes the decisions! To help you, CHM Inc. offers many services to manage your rentals with complete peace of mind and maximize your profitability.

- Rental real estate provides a decent return (between 5 and 10% on average) thanks to the rental income received and the potential capital gain on resale. We give you all the tips to make a good purchase! In addition, if you opt for a tax system, you further reduce the overall cost of your rental property project.

- Buying an apartment to rent out is an attractive solution for preparing for retirement, thanks to the additional income generated by rents, and a good strategy for passing your assets to your children.

Are you convinced of the benefits of investing in rental property? Now let’s see the purchase criteria and steps for a good return on investment.

1. Define your investment goals

Before jumping headlong into the search for a nice apartment to buy to rent, it is necessary to determine your objectives:

- Build long-term wealth?

- Receive regular additional income?

- Realize a capital gain on resale?

- Reduce your taxes?

- Recover housing in several years to live there?

- Become famous in the world of vacation rentals?

Your choices will influence the property type, location, and tax arrangement. Opt for a well-maintained apartment in a high-demand area for higher rental income. Alternatively, invest in an older property to renovate and increase its resale value. When inheriting property, explore ways to minimize inheritance taxes.

For buying a house for Airbnb, don’t hesitate to contact a wealth management advisor to carry out an asset and personal assessment: age, marital and family situation, distribution of your current assets, available reserves and savings capacity, current loans, level of taxation, etc.

This analysis allows you to obtain a global vision to make the right decisions and anticipate the next stages of your life (marriage, child, studies to pay, dependency on a parent, etc.) as well as the risks and hazards of life (loss of job, accident, death, etc.).

2. Set your budget and financing

Now that you know why you want to buy a house for Airbnb to rent out, it remains to determine the envelope amount and how you will finance your project. Several criteria must be considered:

- Your available savings;

- Your debt ratio and your borrowing capacity;

- Your level of income (to which will be added the rents provided by the future rental, retained by the banks up to 70% of the amount of the rent);

- Your possible savings effort to determine the amount of your future monthly loan payments.

Thanks to the leverage effect of credit, you can acquire real estate even with a small personal contribution. However, keep in mind that the rent does not always cover the monthly payment of your loan and that you will have to be able to repay the loan even in the event of a rental vacancy.

3. Market research for buying a house for Airbnb successfully

The decision to buy a house for Airbnb is crucial. And the location of a property is certainly THE criterion not to be overlooked. The attractiveness of the municipality, rental demand, population growth, employment pool, transport, services, schools, shops, leisure, green spaces… many criteria come into play. Of course, it is impossible to tick all the boxes, but renting accommodation must meet the primary needs of your future tenants.

Start by targeting cities near you: you already know the area and it will be easier to manage the apartment rental later.

3 tips to consider before buying a property for Airbnb

Browse real estate sale websites to assess the amount of housing available for purchase and on the rental market, price levels, average rental rates, etc. You will see if rental tension exists if the rents charged make it possible to make a rental investment profitable if specific neighborhoods are less in demand.

4. What type of property is worth buying for Airbnb tenants

In general, small areas (studio and one-bedroom or even three-bedroom apartments) offer the best returns, especially since rental demand for this type of accommodation is vital. Beyond that, larger properties are less profitable but limit rental vacancy and the risks associated with frequent changes of occupants.

- 1BR studios and apartments are perfect for students or young professionals. The demand is located in cities, near universities and colleges, or in the city center to take advantage of the many services, transport facilities, and the animation that reigns there. These areas are often offered for furnished rentals, with a rent difference of 10 to 20% higher than for unfurnished rentals;

- The 3Br and 4Br apartments suit young couples (with or without children) and families. Favoring a location in large cities and medium-sized towns with high demand is safer. Proximity to business areas (tertiary or industrial) or direct access to the transport network, the presence of leisure facilities and green spaces will be all assets to attract workers and parents of young children;

- The detached house can generate a good return if well located because the rental vacancy is low and damage is infrequent. To attract families, wealthy working couples or young retirees, invest in a house in a quiet area, close to schools, cultural venues, and green spaces… and choose a house with an exterior, it’s a real plus!

5. What is better: new or old apartment

Buying a new or old property to invest in Airbnb is quite possible. Advantages and disadvantages, here are the elements to take into account to choose:

7 points to think of when choosing between the old and new property

| Points | Things to consider |

|---|---|

| Selling price |

|

| Expenses |

|

| Notary fees | The acquisition costs and notary fees amount to 2 to 3% in the new, against 7 to 8% in the old. |

| Acquisition procedures | Acquisition deadlines and procedures are more restrictive in new real estate. By buying in the old, you can rent faster. |

| Location | It is easier to judge the attractiveness of the neighborhood where an old dwelling is located than a new one, often built in new development areas out of the city center. |

| Tax exemption schemes | Rental investment in new construction is often associated with tax exemption schemes. In the old purchase, taking advantage of tax advantages on the taxation of rental income is possible. But it all depends. |

| Capital gain | On resale, a new apartment is no longer new… and therefore suffers an immediate depreciation: its potential for capital gain is lower than for an old property which can appreciate over time. |

At first glance, purchasing an old property seems more flexible and less expensive, but it will be necessary to study the project as a whole, with a long-term vision, to have all the cards in hand, particularly on the cost of work and maintenance.

6. Consider buying a house for Airbnb as an investor

When you want to buy an apartment to rent out directly, you have to keep a cool head and remain objective in your decisions to avoid mistakes. Your perspective should be that of an investor: does your product correspond to a market? Does it meet the needs of future tenants? This is all that matters to make a profitable investment.

Do not turn away from your objective because of an attractive price in a disaster area, because the floor at the tip of Hungary is superb, or because this 4BR is in excellent condition. However, it is located near a university… You will have understood it, you have to put your affect aside when you buy to rent.

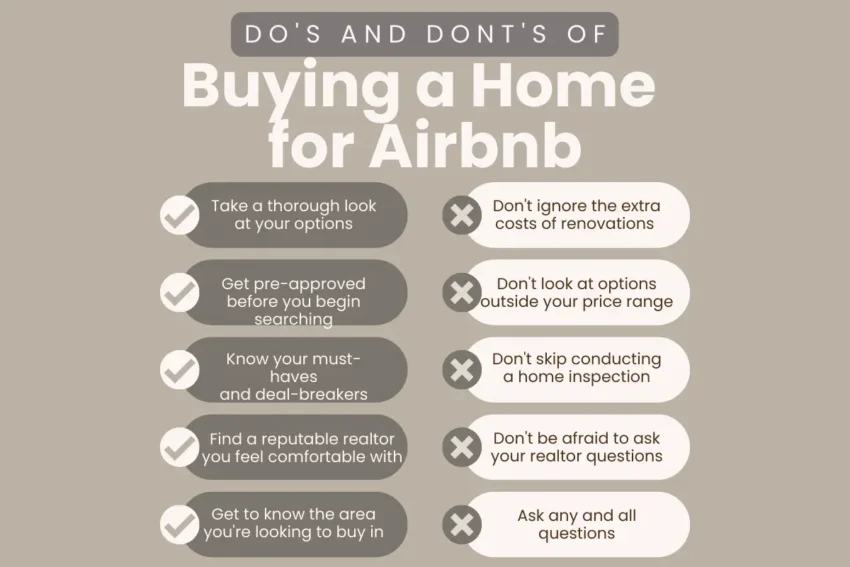

Do’s & dont’s for buying a home for Airbnb

Another piece of advice, especially if this is your first rental investment: don’t think too big. It is better to start with a “small,” realistic, and sustainable project in the long term that will not choke your daily budget. You will be able to develop your housing stock afterward.

7. Look into real estate taxation terms and conditions

When buying a house for Airbnb or any other short-term rental venture, it’s essential to consider the taxation aspects to ensure that you maximize profitability and comply with all legal requirements. Taxation can significantly impact your rental income and overall financial situation, so studying the relevant tax measures based on your specific circumstances is crucial.

7 taxation aspects of short-term rentals

| Aspect | Description |

|---|---|

| Rental income tax | Tax on the income earned from renting out the property is to be reported on personal income tax returns. |

| Local and municipal taxes | Additional taxes, such as occupancy or tourist taxes, are imposed on short-term rentals. |

| Deductible expenses | Expenses related to operating the Airbnb property that can be deducted from the rental income for tax purposes. |

| Depreciation | A tax deduction allows a portion of the property’s value to be deducted over time to account for wear and tear. |

| Tax reductions/incentives | Tax breaks or incentives are offered for short-term rental properties that meet certain criteria or support local tourism. |

| Transitory tax regulations | The regulatory environment for short-term rentals can change, and new taxes or regulations may be introduced. |

| Consultation with a tax professional | Seeking advice from a tax pro or accountant experienced in rental income and property taxes to optimize your tax strategy and ensure compliance. |

Each situation is unique, and the tax implications of an Airbnb property can differ widely depending on many factors. Taking the time to research and understand the tax aspects of your investment will go a long way in maximizing your profitability and avoiding any unforeseen tax issues.

8. Managing property on your own or delegation to the rental management company

After buying a house for Airbnb, as an owner, you can entrust your property’s management to a real estate agency or keep this prerogative for yourself and rent your apartment directly, each time with advantages and disadvantages.

Delegate rental management to a third party

The property management service is divided into two parts: marketing (visits, studies of files, drafting of the rental lease, etc.), and day-to-day management (rent collection, sending receipts to the tenant, monitoring of repairs at the owner’s expense, management of the exit of occupants, etc.).

These services have a certain cost: on average, from 10% to 30% of the rent for day-to-day management. Other indirect costs may be added, especially for small works, because the agency calls on partner craftsmen, whose prices are not always competitive.

Going through professional hospitality management can relieve you of the search for tenants and regular monitoring. However, this solution also relieves you of a significant part of your rental income. It has a major drawback: the loss of control over the decisions that affect your property: choice of tenant, choice of craftsmen, choice of materials, etc.

Delegated management is suitable for owners who do not wish (or cannot) take care of their rental and who agree to reduce their rental yield. You may consider our professional Airbnb property management services, which will help you succeed on this platform quickly.

What is the point of managing your property alone?

First of all, why “alone”? CHM’s mission is precisely to support you in all the steps related to rental management. It is also preferable to be supported to avoid errors and any disputes that may arise.

Renting your property directly allows you to control all decisions and limit costs. You also have a direct relationship with the tenant, making it easier to avoid misunderstandings or to react quickly in case of difficulties (unpaid, neighborhood disturbances, etc.).

In addition, independent rental management gives you cost control:

- Either you are confident enough to manage the aspects of renting out, drafting the lease, entering and leaving the premises, etc., on your own. ;

- Either you choose to be accompanied on certain points by an online rental management software like BailFacile. A good solution to save money and time while having the support necessary for the success of your rental!

The only downside, renting and directly managing an apartment requires involvement on your part, in time and legal or regulatory knowledge. In return, your rental yield could increase by more than 20%! A non-negligible sum that can be invested again… in rental real estate. Especially since there are inexpensive solutions to facilitate property rental management.

9. Select your tenants for Airbnb carefully

Property owners and landlords mainly fear three problems:

- Unpaid rent for the accommodation;

- Low level of occupancy of the property;

- Damages and defects after tenants.

As zero risk does not exist, the choice of renters is a crucial point in the success of your investment.

Studying the rental file is important to select tenants objectively. Engage in conversations with candidates, showing interest in their life, hobbies, and plans (while respecting personal boundaries). This interaction helps detect essential signals, like distant workplaces or strong travel desires, which may impact their lease duration.

In any case, take the time to choose your guests. It is better to lose two weeks of rent than to select a bad profile.

10. Insure yourself against rental risks

To make your rental property investment profitable, it is strongly recommended that investors take out a rent guarantee investors (RDI) to protect themselves against unpaid rent and possible damages.

Generally, it takes 1.5 to 2.5% of the amount of the rent to be insured against these rental risks. Do not hesitate to compare the offers of traditional insurance companies or online brokers to find the best prices and services.

As a conclusion

The right choice of buying a house for Airbnb is key to success. Factors like location, property condition, and taxation directly impact profitability. A well-chosen property can boost income, while considering tax arrangements can optimize returns. Thorough research and careful decision-making are essential for a profitable venture.

Frequently asked questions about

buying a house for Airbnb

1. Is it a good idea to Airbnb your home?

Renting out your property on Airbnb might be a smart move to make additional money. But it takes time and work and could cost money in maintenance. Before making a choice, take into account local laws, the appropriateness of the property, and your willingness to handle visitors. If you go ahead, put safety first and make sure guests have a good time.

2. Is it worth starting an Airbnb?

Airbnb links visitors with hosts renting out their space through its online marketplace. As a result of this service’s recent surge in popularity, the business has established itself as a pioneer in the hospitality industry.

Advantages of Airbnb as a potential investment:

- The need for more genuine and customized travel experiences has contributed to the ongoing growth of the travel and hospitality industries.

- To enhance user experience and draw in new customers, Airbnb is adopting innovations and technology.

- The business may broaden its offerings and geographic reach, which might impact future revenue growth.

However, it is necessary to take into account possible risks:

- The hospitality industry is very competitive, and traditional hotels and other platforms are beginning to put more pressure on Airbnb.

- Different rules and regulations apply to Airbnb in various nations, which might impact how it does business.

- The hotel sector, particularly during a crisis or epidemic, may negatively impact a company’s profitability.

Thoroughly assess the company’s risks, prospects, financial facts, and research if you are considering investing in Airbnb.

3. How to start investing in Airbnb?

Investments in Airbnb can be profitable, but market research, careful property selection, regulatory analysis, and marketing plan analysis are required. Consult with financial advisors before starting. Patience and adaptability are essential for success.

4. How do I run a successful Airbnb?

Running an Airbnb successfully requires planning, professionalism, and attention to detail. Here are some tips that can help you manage your Airbnb successfully:

- Ensure cleanliness, comfort, and safety for guests. Providing quality towels, bed linen, free Wi-Fi, and basic amenities will positively affect reviews.

- Present your property in the best possible light. Professional photos can attract more tenants and increase the popularity of your property.

- Use social media, online advertising and ad optimization to attract more guests.

- Set competitive prices, but also consider the seasonality and popularity of events in your area.

- Be prompt and professional in responding to guest inquiries. Let them know that their comfort and satisfaction is your priority.

- Ask for feedback from satisfied guests, appreciate constructive criticism and work to improve services.

- Comply with all legal and regulatory requirements regarding short-term rentals in your area.

- Ensure regular maintenance and timely repairs to keep your property in good condition.

- Be prepared for changes and fluctuations in demand. Work patiently to improve your skills and processes.

- Use tools and applications to automate reservations, communicate with guests, and manage cleaning schedules.

The success of an Airbnb host depends on professionalism, adherence to high standards, and the ability to adapt to change. Offer your guests an unforgettable experience, positively affecting your ranking and income.

5. How hard is it to be an Airbnb host?

Becoming an Airbnb host can be a fun and rewarding experience but also require effort and responsibility. Here are some factors to consider for a better understanding:

- Cleaning is required. This can be time-consuming and labor-intensive, especially if you own several houses or reside far from your destination.

- Active marketing and efficient communication with potential renters’ interested parties and visitors throughout their stay are required.

- Maintaining good ratings and reviews is crucial for drawing in new customers. You must pay close attention to the wants and requirements of visitors.

- Short-term rental laws and regulations may vary between various nations and areas. To stay out of trouble, you must abide by the law.

- Effective money management is essential and should account for expenditures such as cleaning, maintenance, and repairs.

- The demand for your property may change over time depending on the area and how well-liked it is, which will have an impact on your income.

Being an Airbnb host might be difficult, but many individuals find it enjoyable and successful in their financial endeavors. Using Airbnb as a rental property manager might pay off if you’re ready to invest time and effort.

6. Is Airbnb a good long term investment?

The value and profitability of any investment, including Airbnb, must be evaluated in the long run in light of a variety of considerations. For example:

- Depending on the market, demand for short-term rentals like Airbnb may change. For instance, the number of tourists, city-wide events and conferences, pandemics, or other emergency circumstances.

- Various governments and cities may enact laws governing short-term rental businesses, which might impact their viability and legality.

- Your ability to draw tenants and set pricing may be impacted by competition among Airbnb users.

- Short-term rental homes may experience more and more rapid wear and tear, which may necessitate greater expenditures for repairs and upkeep.

- There is a chance of income reduction or capital loss, just like with any other investment.

To make the right decision regarding investing in Airbnb, we recommend that you contact pro financial advisors or real estate experts.

7. Can you have an Airbnb without owning?

Yes, you can use Airbnb without owning real estate. For this, you can consider other options:

- If you rent an apartment or house and your lease allows you to rent out excess space, then you can list that space on Airbnb.

- If you have permission from the owner and/or landlord, you can rent out a private room or shared space if you live in the location.

- If you have the owner’s permission, you can rent out your home when you’re not living there yourself (for example, when traveling or on vacation).

- You can agree with the property owners on cooperation, where they will handle the management and support, and you will provide the guests and their service.

If you want to become an Airbnb host, you should carefully review the platform’s rules and policies and secure any permissions that may be required from the owner or landlord, depending on your situation.

8. How much do Airbnb owners make?

The location, size, degree of comfort, seasonality, popularity of nearby events and holidays, and market competitiveness impact how much money an Airbnb owner makes. It also depends on how much time you are ready to spend dealing with them and offering them facilities.

Example 1: A small apartment in a popular tourist area

- Per night: $100 – $200

- Profit per month (70% occupancy): $2,100 – $4,200

Example 2: An average house in a city with a good reputation

- Per night: $150 – $300

- Monthly profit (60% occupancy): $2,700 – $5,400

Example 3: A large mansion near a beach or mountain resort

- Per night: $300 – $600

- Monthly income (50% occupancy): $4,500 – $9,000

Those are the only examples. The results may vary depending on your region’s realities and conditions. We recommend researching similar properties in your area through Airbnb or contacting the CHM Inc. team for more accurate earnings estimates.

Updated on: . Author: