Airbnb hosts need to fill out a W-8 tax form from the US Internal Revenue Service (IRS)

Recently, Airbnb hosts have been receiving information about the need to fill out a W-8 tax form from the US Internal Revenue Service (IRS), and, as a rule, they get stuck. “Why on earth should I fill out anything at all? Considering that I am not a US citizen, I have no business in this country and have never been there!” And we recently found ourselves in the same situation! We also asked the same questions. But first things first.

Our company has been working with Airbnb for many years, but we have never filled out this tax form before. We also asked other Airbnb hosts in the Dominican Republic and elsewhere, but they say this is the first time they have heard of such a tax form and have never received an email asking them to fill it out.

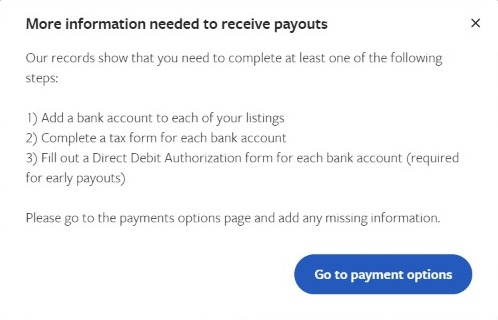

What’s most striking is the lack of any notifications in the Airbnb system itself. A message asking you to fill out tax form W-8 comes to the e-mail address to which the account is linked. They give (as we had) only 4 days to fill out the form, and from the 6th day, tax calculations for each reservation begin.

Nobody cares if you haven’t checked your e-mail, that the letter can get into spam, get lost among other letters, etc. What’s more, Airbnb has a very short deadline for filling out this tax form, and there was nothing in the email we received about the deadline.

On the Airbnb forum, some hosts began to ask questions about the unexpected taxes since 2016, but Airbnb has not yet given a clear answer. Airbnb’s support uses only generic messages, which do not clarify the situation at all. Airbnb provides only such information.

For example, on VRBO, a message asking you to fill out this form appears in the system when you enter the listing each time. Such messages appeared on VRBO back in early June 2020, but even though some tax forms were filled out only at the end of August 2020, VRBO did not make any additional calculations from our earnings in the IRS all this time, and almost three months.

VRBO message asking to fill out IRS Tax Form

To make the situation with Airbnb and the W-8 tax form clearer, we have described everything point by point, and also added screenshots of all correspondence:

- On August 1st we received the first e-mail to fill out the form W-8.

- On August 5th we received the second e-mail to fill out the form W-8.

- There were no notifications about the change of taxation on Airbnb system via e-mail after August 5th. There were no calls or additional messages that the amount of payments would change due to taxes.

- On August 5th we saw a difference in the amount of payments on the page “Home” and “Performance”. We wrote to the Support of Airbnb, but they did not explain this difference in amounts in any way. They said they had some kind of experiment. THEY DIDN’T start looking at the payments and figuring out why the amount changed. They just said they didn’t know why it had happened or passed our problem to someone else.

Airbnb Support message

- We tried to find out the reason for almost two weeks, but did not receive any answer from them.

- On August 25th we saw that the tax was taken from the amount of payments on reservations, wrote to the support, but they did not reply on the same day. They answered calls only on the second day. They did not communicate with us in the channel, but only through e-mails. (one message every two or three days).

- The support service did not respond to all three open cases in the channel. All the questions that we asked them were answered selectively to 3 of them (you can find these questions below).

- No host who has a business or just work through Airbnb as we do has received such a message.

Our message to the Support of Airbnb

looked like this:

Dear Airbnb, I am a SuperHost 15x times. During all these times I showed loyalty and dedication as a host. It is a very difficult time now, as you are always mention on the phone and in chats. Please, help me to figure this up urgently, otherwise, I can’t work like this.

1. Day 5 of Aug you sent an e-mail with updated tax information. I couldn’t see it because I was abroad and I couldn´t access my e-mail because my phone number of the local operator was not in roaming in Europe. I was absolute, 100% sure that if I am responding to all the guests’ and support messages on the platform, everything is good. No messages no notifications inside Airbnb platform itself about the need to update the tax information. You can even check my own reservations as traveler and confirm that I stayed outside the Dominican Republic during that time, because I myself booked apartments in Ukraine!

2. Day 5 of Aug, the payout amount changed on the host dashboard. I immediately contacted Airbnb support. No clear explanations, no guidance. The support member told me there must have been some discrepancy in calculations, but that it was not a big deal. It took me two more weeks to discover the reason for the change of the amount myself: Airbnb just started to send our super hard-earned money to IRS of the US. Based on what logic? I am not a citizen of the US. I don’t have a company in the US. I live and operate in the Dominican Republic. I am attentively reading all messages and notifications within the Airbnb platform.

3. I immediately started to contact Airbnb support to no avail. My messages or calls to support did not give any results.

4. I am paying to the landlords based on what I am making because of changed COVID-19 conditions. It is extremely hard to run the business. Pay salaries, and provide new cleaning standards. Now, because of Airbnb tax invention and “experiments” as your support specialists say, I must pay out of my pocket, leaving the family without any necessary support. I am sorry I can’t pay $1900 out of my pocket just because someone decided to conduct an experiment on my account! BTW, $1900 is equal to 9.5 average monthly salaries in the Dominican Republic! Can you imagine the scope of the issue and the loss?

5. It becomes absolutely unbearable with this Tax issue. I cannot accept guests anymore under these conditions. How am I supposed to operate like this? In addition to super hard conditions with this policy.

6. I asked other hosts from the Dominican Republic, friends of mine, if they have received a tax update request e-mail like me. They have not. So, this experiment has not affected them. What did I do to receive such a letter? I have a confirmation that other hosts did not receive such letters.

7. I want to know:

7.1 What made you send the money to IRS without any notifications inside the Airbnb message thread?

7.2 Where is the money you sent on TAX? I don’t have any legit Tax number in the US, nor Social Security number, I am not a citizen of the US. I don’t have a company in the US.

7.3 What am I supposed to do to get them back to the account?

Please, I need to fix this ASAP. Taking into consideration my hard work of being a SuperHost for 15 times. Deliver such a great experience to our guests. (Check our reviews). COVID-19 brought us all a very difficult time. But this change is literally killing me. How am I supposed to operate like this anymore paying to all the partners and landlords from my pocket?

I am attaching a list of reservations affected by tax withdrawing and the corresponding amounts.

We understand that most likely we will not get this money back, but we would like to warn other hosts, as well as draw the attention of the Airbnb management to this problem! We are sure that we are not alone, whose account was chosen as an “experiment” or just like that. All hosts make their profits through the American company Airbnb, therefore, everyone must fill out a W-8 tax form. Then why are only a few requests for filling it out, no notifications appear in the system itself, and Airbnb’s Support cannot give a clear answer?

What a W-8 tax form is and why it needs

to be filled out on Airbnb?

To better understand what a W-8 tax form is, why it needs to be filled out, how long it is valid, and more, we’ve put together some very useful information below.

So, if you participate in any bonus or affiliate programs (a popular example is iHerb.com), take orders on freelance exchanges such as Upwork, list your property on platforms such as Airbnb, VRBO, work with TripAdvisor, use payment systems or services such as PayPal or Payoneer you may be required to complete some form of tax form from the IRS.

In the vast majority of cases, filling it out is just a non-binding formality. Without which, however, the American company that is your source of income cannot continue to work with you.

We are not talking about paying taxes: if you do not live in the United States, you are not a tax resident of this country, then, of course, you don’t owe anything to anyone, and if necessary, declare all income and pay taxes at home. But your American partner needs a completed form for tax reporting.

Many companies to simplify the life of their counterparties, automate the process: you do not need to print anything, fill out by hand, send anything – just tick the boxes and confirm the data. But there are also enough of those who act in the old-fashioned way – only informing that a completed and signed form for the Tax Service is urgently needed. And some even demand to send a paper original by mail, refusing to accept a scanned copy.

It seems that you can fill it out. There is no need to search for the form: usually it is offered to download from the irs.gov website, where a document with explanations is presented. For example, iHerb.com has collected all the necessary information on one page. Links to forms, explanations for filling – just select, fill out, photograph, download.

Also, let’s define the forms that the United States Internal Revenue Service (IRS) provides for reporting. There are several of them, and in order to choose the one you need, it is enough to answer a number of easy questions.

IRS Tax Forms

| Are you a US citizen? | Are you a business owner who pays taxes in the United States? | Are you a legal entity? | Your IRS Form |

|---|---|---|---|

| Yes | Yes/No | Yes/No | Form W-9 |

| No | Yes | Yes | Form W-8ECI |

| No | No | No | Form W-8BEN |

| No | No | Yes | Form W-8BEN-E |

It is not difficult to come to the conclusion that the vast majority of Airbnb hosts choose the W-8BEN form, since they are individuals, citizens of their country, who do not have business in the United States.

Why is W-8BEN tax form required?

The receipt by an individual of any income in the form of interest, dividends, royalties, and so on from sources in the United States in the absence of an employment contract involves the payment of taxes at a rate of 30%. This amount must be paid by the same “source”, that is, the company with which you work, which in this case acts as a tax agent. And, in order to exempt your income from taxes in the United States, confirming that you are not a tax resident of this country, the Form W-8BEN is needed.

What amounts are we talking about?

The form is submitted if you received income from a US company in excess of $600 in a calendar year.

Who should I send W-8BEN to?

The completed form is only provided to your US counterparty for reporting purposes. You don’t need to send it anywhere else, including the IRS.

Is there a validity period?

The document is valid for three years, or until the status of the taxpayer or any other data changes.

And if there are several partner companies?

Depending on the number of US companies you do business with, a W-8BEN may be required for each of them. This is a common practice: each company needs to individually report to the tax office.

No one will contact you at the specified addresses, no data is transmitted to the fiscal authorities at the place of residence either. You shouldn’t worry about this.

The form is filled out in one copy, which is sent to the tax agent (that is, the company with which you work). No stamps, no confirmation of receipt is needed. Usually a photocopy is sufficient, but sometimes the original is required, which is sent by mail to the specified address.

We really hope that the Airbnb management will pay attention to this problem, and other hosts will know that such a situation may arise for them, but having all the information that we have given above, they will be able to quickly solve everything. If you receive a request from Airbnb, VRBO, TripAdvisor or any other service to fill out a W-8 tax form, do not hesitate if you do not want to waste a lot of money and time to sort things out.

Updated on: . Author: