Vacation Rental Insurance for Hosts – Coverage You Need Beyond Airbnb AirCover in 2026

A vacation rental business is a huge adventure, and for many hosts, it’s an amazing chance in an increasingly booming market. Many real estate owners want to rent out their properties on different booking platforms like Airbnb. However, before it, a new Airbnb host must think of the legal and practical aspects of short-term rentals, particularly regarding insurance.

Taking out satisfactory insurance is a must to protect your property and belongings, and it’s your duty as a host. The issue of insurance can often seem complicated and confusing, but it shouldn’t be ignored. Indeed, in case of an unforeseen incident or problem, fine coverage can make all the difference between a manageable situation and a financial disaster.

Airbnb insurance for a host and gaps you have to know

What is Airbnb Host Insurance?

Even if plenty of stays go smoothly, it’s important to remember that accidents can happen quickly and suddenly. So, who is responsible if something unexpected happens during your guests’ stay? Are you covered by the Airbnb platform? The answer is… yes! We’ll tell you more.

Airbnb AirCover

Airbnb AirCover is a suite of insurance policies designed to protect Airbnb users. These policies aim to offer peace of mind to both hosts and guests by providing financial protection in the event of incidents during stays.

Airbnb AirCover includes guest identity verification, reservation verification, liability insurance for hosts, and damage protection.

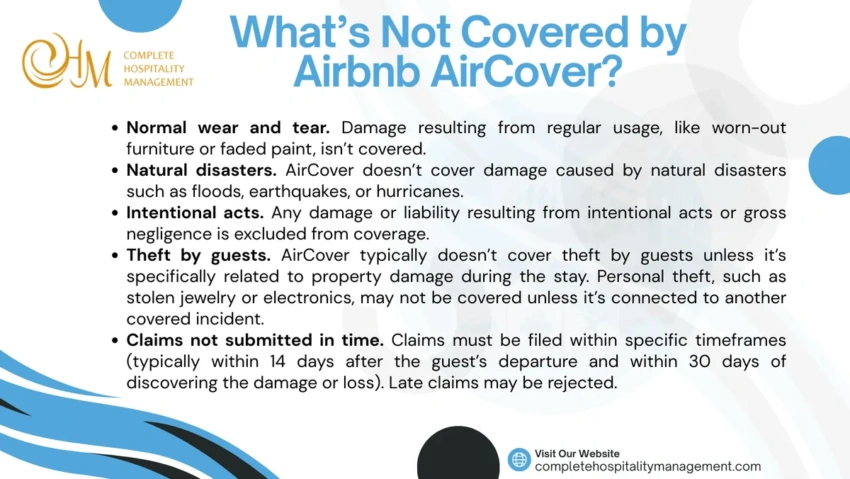

Things not covered by Airbnb AirCover

Host liability insurance

Host Liability Insurance, included in the AirCover program, provides coverage up to $1 million in exceptional cases where a host is legally liable for injuries sustained by a guest or damage to their personal belongings during their stay. This insurance also extends to people who assist the host, such as co-hosts or cleaning staff.

- Some situations are not covered, such as intentional acts or damage to the host’s personal property, which are covered by the Host Damage Guarantee. The complete terms of the Host Damage Guarantee are available here.

- Enrollment in this insurance is not necessary, as AirCover for Hosts is automatically included with every booking on Airbnb, providing free protection every time a guest stays in a property booked through the platform.

Guest damage guarantee

The Guest Damage Guarantee, also included in AirCover, provides coverage of up to $3 million in the exceptional event that your accommodation or belongings are damaged by a guest during a stay. This guarantee also reimburses you for certain additional cleaning costs, such as stain or odor removal, as well as for damage caused by pets.

It covers damage caused by guests to your accommodation, furniture, valuables, or personal belongings, as well as damage to parked vehicles. It also provides compensation for lost income in the event of cancellation of confirmed reservations due to damage caused by a guest. However, this guarantee does not cover damage due to normal wear and tear or damage caused by natural disasters.

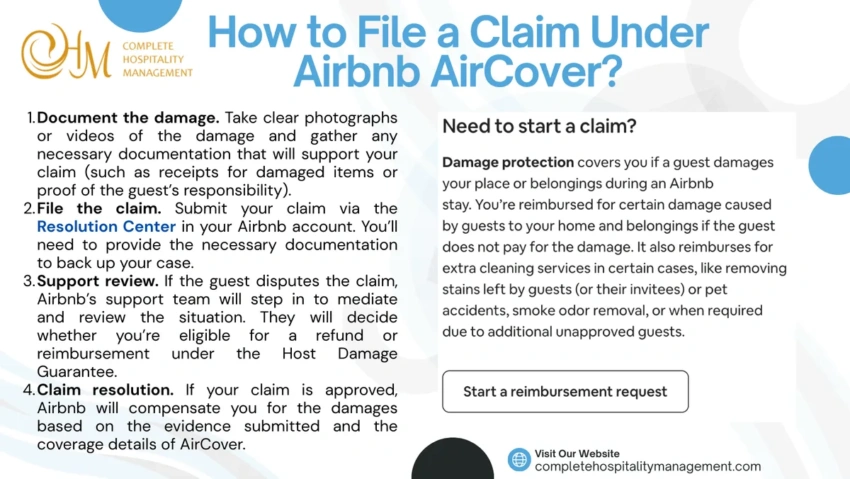

To request a refund, you must gather evidence of the damage and then initiate a refund request in the Resolution Center within 14 days of the guest’s departure. If the guest does not respond or refuses to pay, you can submit a refund request under the Host Damage Guarantee, and Airbnb Support will review the request.

How to file a claim under Airbnb AirCover

It’s important to note that if you wish to involve Airbnb Support in your request, you must do so and submit supporting documentation within 30 days of discovering the damage or loss.

Cancellation insurance for vacation rentals on Airbnb

1. Host cancellation

While hosts should avoid canceling reservations on the platform as much as possible, as it can result in negative consequences such as fees, loss of Superhost status, and even complete removal of the listing, there are certain situations where a host can cancel without negative consequences.

Cancellations may be necessary in exceptional circumstances, such as force majeure damage to the property, emergency repairs, serious illness, or if a guest plans to violate the house rules. In such cases, Airbnb can help find alternative accommodations for guests at no cost to the host. Hosts must then provide supporting documentation for these exceptional cancellations or in cases of force majeure, such as photos for emergency repairs or a medical certificate in case of serious illness.

2. Guest cancellation

With the Host Guarantee, Airbnb offers cancellation insurance for owners. This guarantee can provide protection in the event of a tenant canceling for reasons covered by the cancellation policy chosen at the time of booking.

Hosts can select from several cancellation policies with different levels of protection, such as flexible, moderate, or strict cancellation policies. In the event of a tenant canceling in accordance with the chosen policy, the Host Guarantee can cover the owner’s loss of rental income.

The limitations of Airbnb insurance for a host

While Airbnb hosts can rest assured that they are protected by the damage and liability insurance that are standard features of AirCover, it’s important to note that the insurance offered by Airbnb has limitations.

- First, the platform’s guarantee is only activated as a last resort, when the dispute has not been resolved directly between the host and the guest.

- Furthermore, certain situations are not covered. This is the case, for example, for damages related to theft, natural disasters, excessive use of electricity, water, or gas, theft or identity theft, or an incident caused by or on an animal. The complete conditions are available here.

- Finally, a large number of AirCover claims are rejected due to the alleged lack of proof provided by the host, which is obviously a major source of frustration for vacation rental owners and managers.

As an owner, it may be a good idea to take out home insurance to strengthen your Airbnb coverage and ensure you can rent with complete peace of mind.

Seasonal Rental Insurance for Airbnb

Are you wondering how to strengthen your Airbnb host insurance and how to choose the right seasonal rental insurance for your business? Here’s the important information you need to know to insure your short-term rental.

Is seasonal rental insurance mandatory?

If you’re wondering if you’re required to insure your Airbnb rental, the answer is no. You are not required to insure furnished tourist accommodation intended for seasonal rental. However, as a host, you can require the guest (traveler) to take out insurance according to the terms of the rental agreement. This can include dedicated insurance, temporary home insurance, or vacation insurance coverage for the renter.

You can also choose to take out comprehensive home insurance that covers the tenant or only yourself. You have two coverage options:

- Who-will-benefit insurance, which protects tenants against any damage they may cause as well as their liability to third parties.

- The waiver of recourse clause, which is less expensive but less protective, only covers damage caused to your own home.

If you opt for who-will-benefit insurance, this means that the coverage applies to all guests and can even include third parties. Therefore, the tenant does not need to have personal insurance in this case.

Does home insurance also cover vacation rentals?

Home insurance can cover your primary residence as well as your short-term rental property, but this depends on the specific terms of the insurance policy.

It is important to carefully check your insurance policy to ensure that your vacation rental is properly covered and that you have adequate protection in the event of a claim or damage. It may also be necessary to purchase specific insurance for seasonal rentals to supplement the coverage provided by your primary home insurance.

Non-occupying owner insurance

Non-occupant owner insurance (NOI) is a specific insurance policy designed for owners who rent out their property without actually living there.

- It offers comprehensive coverage, combining the usual protection of comprehensive home insurance with specific guarantees for owners who rent out their accommodation on a short-term basis.

- It covers repairs in the event of a major loss (such as water damage, fire, vandalism, etc.) occurring during the rental period or while the property is vacant.

This insurance can also cover the guest if they are uninsured or if their coverage is insufficient. In addition, it includes the owner’s civil liability for damage caused to third parties, often providing legal assistance in the event of a dispute.

Specific second home insurance

Second home insurance is an insurance policy designed to cover accommodation used as a second home, i.e., a vacation spot where the owner stays occasionally rather than permanently. It generally offers similar coverage to traditional home insurance, but takes into account the fact that the property is not permanently occupied. Typical features include:

- protection against structural damage (fire, water damage, natural disasters),

- theft or vandalism,

- liability,

- sometimes even loss of rent in the event the property cannot be rented due to a loss.

Specific second home insurance

Policy terms may vary depending on the insurer and the specifics of the property. It is also sometimes possible to request an extension of your primary home insurance. This involves requesting an extension of the comprehensive home insurance coverage from your primary residence to your secondary residence. It is quick to implement but can increase the overall cost of home insurance due to the additional specificities of the second home.

Which Vacation Rental Insurance to Choose?

Before choosing insurance to cover your vacation rental, you should assess certain factors. Here are some tips to help you make the right choice.

Know your needs

Determine the types of coverage you need. This may include liability, property damage protection, theft, loss of rent, etc.

Analyzing your insurance needs for vacation rentals

| Coverage type | What it protects against | Why you need it |

|---|---|---|

| Property damage protection | Accidental or intentional damage caused by guests, such as broken furniture or stained carpets. | Protects your investment and minimizes out-of-pocket expenses for repairs or replacements. |

| Liability coverage | Legal costs and medical expenses if a guest is injured on your property or if property damage affects others. | Prevents significant financial loss from lawsuits or claims related to injuries or accidents. |

| Loss of rental income | Lost income if your property becomes uninhabitable due to a covered event (fire, water damage, etc.). | Ensures stable income even during repairs or temporary closures. |

| Theft protection | Theft of personal belongings or items provided for guest use (electronics, furniture). | Compensates for stolen items, reducing financial loss. |

| Natural disaster coverage | Damage from natural events like floods, earthquakes, or hurricanes. | Protects against major property loss in disaster-prone areas. |

| Pet damage coverage | Damage caused by guests’ pets, such as scratched floors or damaged furniture. | If you allow pets, this coverage helps mitigate risks associated with animal behavior. |

| Vandalism coverage | Intentional damage caused by guests or unauthorized individuals. | Ensures reimbursement for costly repairs due to malicious acts. |

| Extended vacancy coverage | Protection for periods when the property is unoccupied. | Avoids gaps in coverage during off-peak seasons when the property may be vacant. |

| Guest relocation assistance | Costs of relocating guests if your property becomes uninhabitable during their stay. | Prevents potential negative reviews and covers unexpected expenses related to guest relocation. |

Check your existing home insurance

If you already have home insurance, check if it covers vacation rentals. Some home insurance policies offer some protection for short-term rentals or extended warranties, but this can vary:

- Many standard homeowner policies exclude coverage for short-term rental activities. Confirm if your insurer views vacation rentals as a business activity.

- Some home insurance providers offer optional endorsements or riders for vacation rental coverage. Ask if these are available and what they include.

- Assess whether your liability coverage is sufficient to protect you against potential lawsuits from guests. Short-term rental risks can be higher than typical homeowner situations.

- Check if your policy covers loss of rental income in case your property becomes uninhabitable due to a covered incident, such as fire or flooding.

- Verify whether your personal belongings, like electronics, appliances, or furniture, are protected against damage or theft by guests.

- Ensure coverage for intentional guest damage and theft. Many standard policies do not cover these scenarios.

- Some home insurance policies limit coverage if the property remains vacant for extended periods. If you have off-peak seasons, confirm the period allowed.

- Hosting guests may be considered a commercial activity, potentially voiding your homeowner’s policy. Confirm with your insurer to avoid coverage gaps.

- If your policy covers vacation rentals, inform your insurer about your hosting activities. Failing to disclose this may result in denied claims.

- If your current policy can be extended to cover vacation rentals, compare the additional cost with specialized short-term rental insurance to ensure it’s cost-effective.

Consult specialized companies

There are insurance companies with special warranties for vacation rentals and/or second homes. These include Proper Insurance, Safely, Travel Guard, Allianz, AXA, Luko, MAIF, GoFriday, Acheel, and others. Compare the offers from these companies to find the one that best suits your needs.

Use online comparison tools

Online insurance comparison tools can help you compare rates and coverage from different companies. You can consider the use of the following ones:

- Le Lynx (France) specializes in comparing French insurance providers, including those offering coverage for vacation rentals.

- Lesfurets.com (France) offers comparisons for home insurance, including specialized vacation rental policies.

- Compare the Market (UK) is a widely recognized platform for comparing home and vacation rental insurance in the UK.

- MoneySuperMarket (UK) is famous for comparing financial products, including home and owner insurance, suitable for vacation rentals.

- Insurance.com (USA) provides comparisons for homeowners and landlord insurance, with some options for vacation rental coverage.

- Policygenius (USA) is an online insurance marketplace offering personalized comparisons for home and short-term rental insurance.

- Finder.com (Global) is a global platform that compares insurance products across multiple countries, including vacation rental coverage.

When using these tools, make sure to input accurate details about your property and rental activities to get the most relevant and accurate quotes.

Final thoughts

While Airbnb offers the host coverage on the platform, it’s a good idea to purchase additional insurance to protect your rental against unforeseen events. By purchasing insurance tailored to your vacation rental, you can benefit from more comprehensive coverage, particularly in the event of property damage, liability, or loss of rental income.

Before choosing insurance, carefully review the terms and conditions to understand everything that’s covered (and, more importantly, what isn’t). Reviews from other owners can also provide useful information on the quality of customer service and claims handling. Don’t hesitate to contact insurance companies for personalized quotes and negotiate terms and rates once you’ve found the right insurance for your needs.

Frequently Asked Questions on

Airbnb Host Insurance

Does Airbnb offer insurance for hosts?

Yes, Airbnb offers two primary forms of coverage for hosts – AirCover for Hosts and Host Liability Insurance.

- AirCover for Hosts is a complimentary protection plan provided by Airbnb, covering up to $3 million in damages caused by guests. It includes coverage for property damage, vandalism, theft, and even deep cleaning in severe cases. However, it has limitations and exclusions, such as no coverage for loss of income during repairs.

- Host Liability Insurance is also included under AirCover. It covers up to $1 million for third-party claims related to bodily injury or property damage. For instance, if a guest injures themselves in your home and sues, this policy could apply.

While these protections are valuable, they are not a replacement for a comprehensive insurance policy tailored to short-term rental hosts. Many experienced hosts still opt for additional insurance to bridge potential coverage gaps.

Do Airbnb hosts have insurance?

Technically, Airbnb hosts are automatically covered by the AirCover program, which includes both property and liability protection. However, not all damages and liabilities are covered comprehensively. If you’re a host, it is crucial to understand that:

- Homeowner’s insurance is traditional homeowner policies that often exclude short-term rental activities.

- Landlord insurance policies typically apply to long-term rentals and may also have exclusions for short-term guests.

- Short-term rental insurance is tailored to Airbnb hosts. These policies cover gaps left by Airbnb’s coverage, like loss of income, intentional guest damage, and liability beyond $1 million.

What insurance do you need as an Airbnb host?

As an Airbnb host, you should consider the following insurance types:

| Insurance type | Coverage | Why you need it |

|---|---|---|

| Airbnb’s AirCover | Property damage, liability up to $1M | Basic protection but has limitations. |

| Short-term rental insurance | Property damage, liability, loss of income | Covers gaps left by AirCover. |

| Homeowner’s insurance (modified) | Fire, theft, personal liability | For personal coverage, but may have exclusions. |

| Umbrella liability insurance | Excess liability beyond primary policies | Additional protection for high-value claims. |

How do I protect myself as an Airbnb host?

To protect yourself as an Airbnb host, consider the following steps:

- Purchase short-term rental insurance since Airbnb’s coverage is not exhaustive. Supplement it with a policy designed for short-term rentals.

- Set house rules as clear, enforceable house rules help minimize risks. Specify limits on parties, smoking, and guest capacity.

- Use Airbnb’s guest verification tools and check guest reviews before approving reservations.

- Install surveillance cameras in common, permitted areas like entrances (never inside private areas). Use smart locks for added security.

- Regularly inspect your property for potential hazards like faulty wiring, loose steps, or slippery surfaces.

What is best insurance for Airbnb?

The best insurance for Airbnb hosts is typically a comprehensive short-term rental insurance policy from reputable providers like Proper Insurance, Safely, or Slice. These policies are designed specifically for short-term rental hosts and generally include:

- Property damage that covers building and contents, including guest-caused damages.

- Liability coverage often extends beyond the $1 million limit of Airbnb’s AirCover.

- Loss of income in case your property becomes uninhabitable due to covered damages.

- Theft coverage for guest and non-guest theft.

- Legal protection in case of lawsuits not covered by Airbnb’s liability.

Choosing the right insurance depends on the specifics of your property, location, and personal risk tolerance. Comparing quotes and coverage details from multiple insurers is advised.

Does Airbnb insurance actually work?

Airbnb’s AirCover, which includes liability insurance and property damage protection, generally works for standard claims like accidental damage. However, many hosts report mixed experiences:

- Many hosts have successfully claimed damages like broken furniture, stained carpets, or accidental guest injuries. Airbnb tends to respond well to claims that fit within its clear guidelines.

- Complicated claims, such as intentional vandalism, loss of income due to damage, or claims involving unverified guests, can be more difficult to resolve. Airbnb often requires extensive documentation, including photos, receipts, and police reports for theft claims.

- Items like cash, rare collectibles, and some types of personal property may not be covered. Additionally, claims above $1 million in liability may not be fully protected.

Experienced hosts recommend documenting your property thoroughly, maintaining clear communication with guests, and considering supplemental short-term rental insurance to fill potential coverage gaps.

Is it safe to be a host on Airbnb?

Yes, it can be safe to host on Airbnb if you take proper precautions. Most guests are respectful, but there are risks involved in opening your home to strangers. Here’s how to maximize safety:

- Use Airbnb’s verification tools, require government ID verification, and check guest reviews before accepting bookings.

- Install outdoor security cameras at entry points (in compliance with Airbnb’s policies), use smart locks, and keep valuables secured.

- Establish and enforce house rules. Be clear about expectations regarding behavior, noise, and the number of guests.

- Airbnb’s AirCover provides some protection, but experienced hosts often opt for additional short-term rental insurance for comprehensive coverage.

- Keep a first-aid kit on site, share emergency contact numbers, and provide clear exit instructions for guests.

Can you buy insurance on Airbnb?

No, Airbnb does not sell separate insurance policies. Instead, it provides AirCover for hosts, which is automatically included for free with each booking. This coverage includes:

- Up to $3 million in property damage protection.

- Up to $1 million in liability protection for third-party claims.

If you need more comprehensive or personalized coverage, you’ll need to purchase insurance through third-party providers specializing in short-term rental insurance, such as Proper Insurance, Safely, or Slice. These policies cover gaps in Airbnb’s AirCover, like loss of income, guest theft, and higher liability limits.

Does Airbnb punish hosts?

Airbnb may impose penalties on hosts for policy violations or issues like:

- Canceling a confirmed reservation can lead to penalties, including fines and lower search rankings.

- If a host violates Airbnb’s non-discrimination policy, unauthorized surveillance policies, or other guidelines, their account could be suspended or permanently banned.

- Repeated guest complaints about safety, cleanliness, or misrepresentation of the listing can lead to listing deactivation.

- Misusing AirCover by submitting false claims can result in penalties or removal from the platform.

However, hosts can appeal penalties, and Airbnb typically investigates disputes before enforcing strict measures. Maintaining transparency and adhering to Airbnb’s policies can help avoid punitive actions.

Does Airbnb reimburse for stolen items?

Airbnb’s AirCover may reimburse stolen items if the theft was committed by a verified guest during a reservation. However, there are important limitations:

- You must provide evidence such as police reports, photos, receipts, and proof of ownership.

- Cash, jewelry, and certain valuable collectibles are generally not covered.

- If a non-verified guest (someone who bypassed Airbnb’s verification process) is responsible for the theft, claims are often denied.

For more comprehensive protection, many experienced hosts obtain short-term rental insurance that explicitly covers theft by guests and non-guests.

What protection does Airbnb offer hosts?

Airbnb provides AirCover for Hosts, a complimentary program that includes two main protections:

- Host liability insurance offers up to $1 million in liability coverage for third-party claims related to bodily injury or property damage. For example, if a guest slips and gets injured, this coverage may help.

- Host damage protection covers up to $3 million for damages caused by guests. This includes accidental property damage, vandalism, and even pet damage.

However, AirCover has its limits:

- It may not cover loss of income due to damage.

- Theft claims require evidence and may not cover items like cash or high-value collectibles.

- Liability coverage has exclusions, especially if local laws or regulations are violated.

Does Airbnb cover you if you get scammed?

Airbnb generally does not cover losses due to scams that occur outside its platform. However, it has measures in place to help prevent scams:

- Always process transactions directly through Airbnb to avoid phishing or fraudulent payment requests.

- Airbnb requires verified profiles, but it is still essential to screen guests carefully.

- If you encounter fraud, Airbnb’s Resolution Center may assist in investigating the issue.

- Airbnb has a support team to handle disputes, but reimbursement for scams is rare unless clear evidence of guest misconduct is provided.

Never communicate or transact outside of Airbnb’s platform to ensure eligibility for any protective measures.

How much does Airbnb take from hosts?

Airbnb typically charges hosts a service fee ranging from 3% to 15% of the booking subtotal. The exact percentage depends on the pricing model selected:

- Split-fee model is the most common. Hosts pay a 3% service fee, and guests pay around 14%.

- The host-only fee model is primarily used by larger property managers. The fee ranges from 14% to 16%, and guests pay no additional service fee.

If your booking subtotal (nightly rate + cleaning fee) is $500, Airbnb might take:

- Split-fee model – $15 from the host (3%) and $70 from the guest (14%).

- Host-only fee model – $75 from the host (15%).

Be mindful of additional charges like local taxes or VAT, which may also apply.

What protection do I have with Airbnb?

Airbnb provides protection through its AirCover for Hosts, which includes:

- Up to $3 million for guest-related damages, including vandalism and pet damage.

- Up to $1 million for third-party bodily injury or property damage claims.

- Deep cleaning reimbursement if a guest leaves a severe mess that requires professional cleaning.

- Income loss but only in specific scenarios, like cancellations due to property damage caused by guests.

While these protections are helpful, they may not cover theft of certain valuables, loss of rental income for extended periods, or damages caused by unauthorized guests. Many hosts use short-term rental insurance to bridge these gaps.

Is Airbnb safe for hosts?

Yes, Airbnb can be safe for hosts if precautions are taken:

- Use Airbnb’s guest verification tools, request government ID verification, and check guest reviews.

- Install outdoor security cameras (complying with Airbnb’s policies), use smart locks, and secure valuables.

- Relying solely on AirCover may leave you exposed. Short-term rental insurance provides more extensive protection.

- Establish and enforce strict rules to minimize risks related to parties, noise, and unauthorized guests.

- Use the Airbnb platform for all communications to have a documented record.

Updated on: . Author: